6 Effective Accounting Tips for Your Business

So, you just started a new business and you feel like you have bitten more than you can chew when you sit down to sort out your accounting records.

No worries, you are not the first to encounter this problem and while you can sign up for some short-term accounting courses, we are going to provide you with basic tips on how to make accounting for your business stress-free.

- Get it organized and sorted.

Remember that piece of paper you receive as evidence for expenses paid and that receipt you issued for sales made, it is important that you keep an accurate count of those. Put it all together in one place to avoid losing some of that precious evidence.

You can sort them out by date and by type. For example, you can make a file for all sales receipts arranged by date and another file for all expenses paid, making little notations along the way detailing the purpose of the expense. This could make the task of bank reconciliation easier for you and your auditors are going to love you for it.

- Reconcile Diligently.

A bank statement is a report provided by your bank summarizing the deposits, withdrawals, interests earned, and bank charges made to your account.

Matching the amounts reflected on the bank statement to your record regularly is very important because sometimes the bank can erroneously charge or deposit amounts to your account. This “matching” procedure is called bank reconciling or doing bank reconciliation.

To make bank reconciliation easy breezy, deposit all your collections intact, that is to say the sum of your collections for the day should equal to the amount you put in your deposit slip. Make sure to retain a copy of your deposit slip. You could also indicate at the back of your deposit slip copy the receipt numbers that made up for the amount deposited.

Bank reconciliations not only give you an idea as to how much money you have in the bank, it is also a tool you could use to keep track of the ins and outs of your cash.

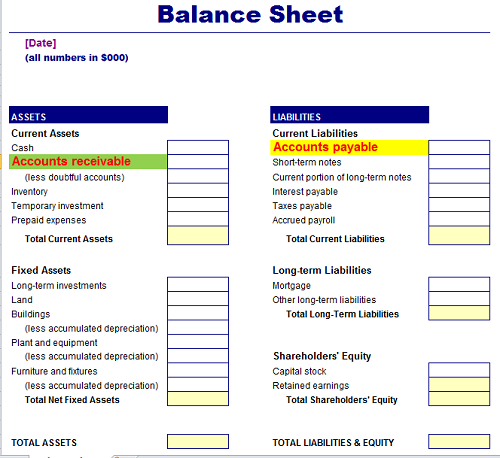

- Keep track of your receivables and payables.

Receivables refer to amounts owed to your business. Keeping track of this is important because the rule of the thumb is, the longer the amount remains uncollected, the lesser the chance of it ever being collected. An uncollected receivable means a loss to your bottom-line.

Alternately, payables refer to amounts your business owes to others. Make sure you settle your payables on time because it could mean losing your credibility to your suppliers or paying additional amounts on top of the amount owed as interest.

- Monitor the finances of your business.

Even though bank reconciliations give you an idea about the movement of your cash, you also need to keep track on how much your business is actually earning.

One of the major mistakes businesses commits is that they prepare their financial statements on an annual basis, hence when they realized that their business is incurring losses, so much time has already passed before remedial actions are taken. Better get that calculator working and prepare your financial statements on a monthly basis.

- Maintain a friendly relationship with the government.

Circle out the dates in your calendar for due dates or remittances to agencies governing your business like the BIR, SSS, PHIC to name a few. This will help you save a few pesos and a whole lot of trouble from the law.

- Seek professional help

When you’re stuck in all the accounting mumbo-jumbo especially during tax periods, don’t be afraid to wave the SOS flag. Seek out help from an accounting firm. Just make sure you got all your records organized and sorted so that you can minimize billable hours.

It would also be of great help if you can enroll yourself to bookkeeping or accounting crash courses, some of which are offered by the government for free. One is never too old to learn something new.

The key to tying up your accounting problems lies mostly in determination and time-management so brush off that little frown, bring out that bit of OCD in you, and go get working.

I really like the way you mentioned how you should monitor the finances of your business. I know the technology has evolved in the areas of business in the last couple of years and I wonder if there’s some sort of software that can help make this whole accounting thing go a little smother. The more you know the better decisions you’re capable of making, right? I appreciate the advice in any case. Thanks for sharing!t

Hi, there are actually a lot of options for you to consider. To name a few, there’s Xero, Quickbooks, and Peachtree (now known as Sage 50).